Latest Version

1.50.2

December 25, 2024

Robinhood

Action

Android

0

Free

com.robinhood.money

Report a Problem

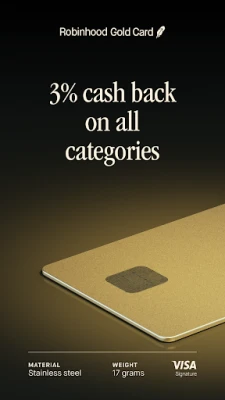

More About Robinhood Credit Card

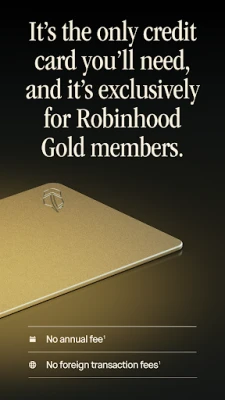

Robinhood is a financial technology company that offers a credit card with unique benefits. With this card, users can earn 3% cash back on all categories, making it a great option for everyday spending. Additionally, there are no annual fees for Robinhood Gold members and no foreign transaction fees, making it a cost-effective choice for international travelers.

One of the standout features of this credit card is the ability to earn 5% cash back on travel when booking through the Robinhood travel portal. This makes it a great option for those who frequently travel and want to maximize their rewards.

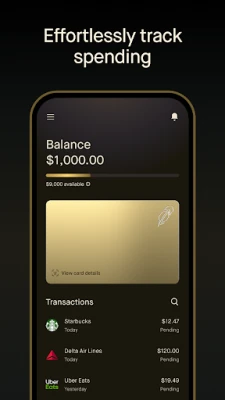

Aside from its rewards program, the Robinhood credit card also offers secure account management. Users can easily track their spending, report suspicious transactions, and freeze or unfreeze their card at any time. This provides peace of mind and protection against fraud.

For those who value privacy and security, the Robinhood credit card also offers virtual cards. These disposable card numbers can be used for one-time purchases or recurring subscriptions, providing a more private and secure way to spend.

Another unique aspect of this credit card is its family-friendly design. Users can add cardholders of any age, allowing the whole family to build credit. Parents can also track family spending, set spending limits, and instantly lock lost cards.

It's important to note that the Robinhood credit card is offered by Robinhood Credit, Inc. and issued by Coastal Community Bank. It is not a bank itself, but a financial technology company. Users can check their credit limit without impacting their credit score and must have a Robinhood Financial brokerage account to redeem cash back. Terms and conditions may apply, and the rewards program is subject to change.

Rate the App

User Reviews

Popular Apps