Latest Version

9.0.61

December 24, 2024

Albert - Budgeting & Banking

Action

Android

0

Free

com.meetalbert

Report a Problem

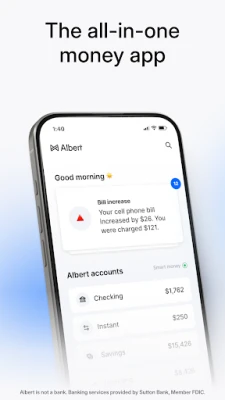

More About Albert: Budgeting and Banking

Budget, save, spend, and invest all in one powerful app. With this app, you can manage your finances and protect your identity 24/7. You can also earn competitive interest rates on your savings and get expert financial advice. A subscription is required, but you can try it for 30 days before being charged.

Spend with Benefits allows you to enjoy the convenience of modern online banking with fewer fees. You can set up direct deposit and get paid up to 2 days early, as well as earn cash back at select stores. It's important to note that this app is not a bank, and all disclosures can be found below.

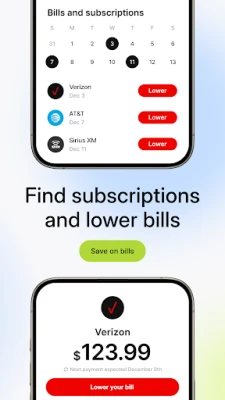

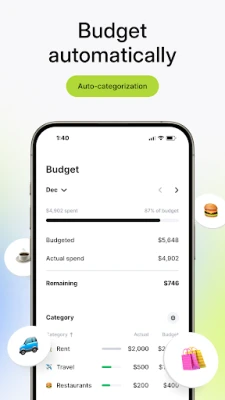

Budgeting and personal finance management is made easy with this app. You can create a monthly budget, track expenses, and use budget planning tools to customize your spending plan. The app also allows you to see all your accounts in one place and track recurring bills. It even helps you find and cancel unused subscriptions and negotiate lower bills.

The app also offers automatic saving and investing features. It will transfer money to your Albert Savings and Investing accounts based on what it thinks you can afford. You can also open a high yield savings account to earn competitive interest rates, or invest in stocks and ETFs or a portfolio managed by Albert.

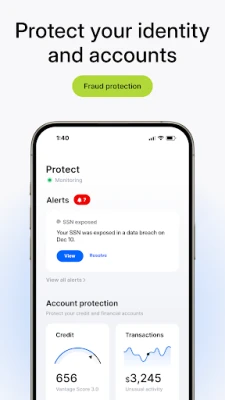

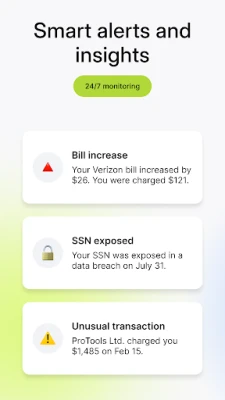

Protecting your money is a top priority with this app. It offers 24/7 monitoring of your accounts, credit, and identity, and will send real-time alerts if a potential threat is detected. You can also keep track of your credit score with the credit score checker.

It's important to note that Albert is not a bank, but rather a provider of banking services. The Albert Cash banking services are provided by Sutton Bank, and Albert Savings accounts are held at FDIC-insured banks. The app also offers a range of plans with fees ranging from $11.99 to $29.99, and you can try it for 30 days before being charged. The Instant Advance feature is also available at the discretion of Albert, with limits ranging from $25 to $250 and transfer fees may apply.

Overall, this app offers a comprehensive and convenient way to manage your finances, with features such as budgeting, saving, investing, and identity protection all in one place. It's important to note that it is not affiliated with other personal finance budget apps, and customer support can be found on their website.

Rate the App

User Reviews

Popular Apps