Latest Version

24.12.1

December 24, 2024

Lili App Inc.

Action

Android

0

Free

lili.co

Report a Problem

More About Lili - Small Business Finances

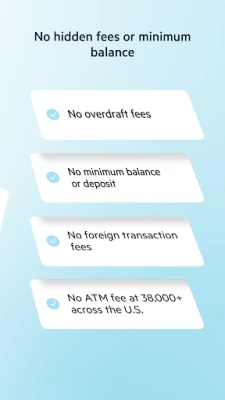

Lili offers a comprehensive business banking solution that includes a business checking account, a Lili Visa® Debit Card, and various features and tools to help small businesses manage their finances. With Lili, business owners can easily deposit checks through their mobile devices, withdraw cash for free at over 38,000 locations, and make cash deposits at 90,000 participating retailers. They can also get paid up to 2 days early, without any minimum balance or deposit requirements, and without any hidden fees. Additionally, Lili offers automatic savings, cashback awards, and fee-free overdraft up to $200. Plus, business owners can earn a competitive 3.65% APY on their savings account.

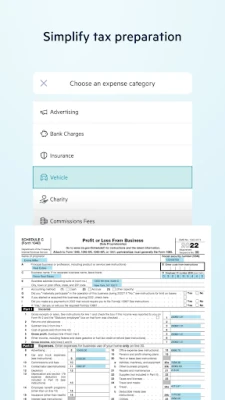

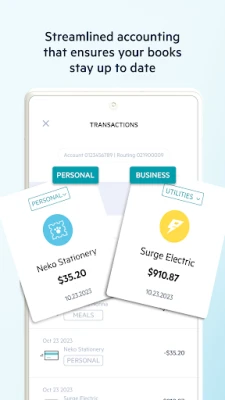

In addition to traditional banking services, Lili also offers accounting software to help business owners manage their expenses and income. This includes expense management tools and reports, income and expense insights, and the ability to attach receipts to expenses by taking a quick photo with their phone. Business owners can also access on-demand reporting, including profit and loss and cash flow statements.

Lili also offers tax preparation services, making it easier for business owners to stay organized and prepared for tax season. The software automatically labels transactions into tax categories, tracks write-offs, and provides automated tax savings. Plus, Lili offers pre-filled business tax forms, including Forms 1065, 1120, and Schedule C.

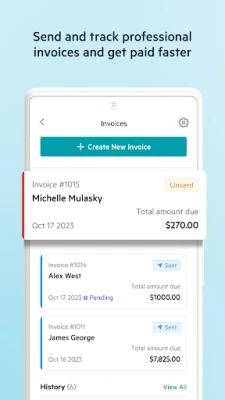

For businesses that need to invoice their clients, Lili offers invoicing software that allows business owners to create and send customized invoices and accept all payment methods. They can also track unpaid invoices and send payment reminders.

Lili also provides support for small businesses through their Lili Academy, which offers videos and guides covering all aspects of running a business. Business owners can also access free tools, downloadable resources, long-form guides, and blog articles. Plus, Lili offers discounts on relevant tools from their partners and curated newsletters and business-related content.

When it comes to account security, Lili takes it seriously. All Lili accounts are insured up to $250,000 through their partner bank, Sunrise Banks, N.A., Member FDIC. Lili also uses industry-leading encryption software and security protocols, including fraud monitoring and multi-factor authentication, to protect their customers' accounts and debit cards. Customers can also receive real-time transaction alerts, access their account from any device, and instantly freeze their card if needed.

It's important to note that Lili is a financial technology company, not a bank. However, banking services are provided by Sunrise Banks N.A., Member FDIC. The Lili Visa® Debit Card is issued by Sunrise Banks, N.A., Member FDIC, pursuant to a license from Visa U.S.A. Inc. Please see the back of your Card for its issuing bank. Some features and services, such as expense management tools, income and expense insights, and pre-filled tax forms, are only available to Lili Pro, Lili Smart, and Lili Premium account holders, with applicable monthly account fees. The Annual Percentage Yield (“APY”) for the Lili Savings Account is variable and may change at any time. The disclosed APY is effective as of October 1, 2024. Must have at least $0.01 in savings to earn interest. The APY applies to balances of up to and including $100,000. Any portions of a balance over $100,000 will not earn interest or have a yield. This account is also only available to Lili Pro, Lili Smart, and Lili Premium account holders.

Rate the App

User Reviews

Popular Apps