Latest Version

3.54.1

November 29, 2024

Varo Bank, N.A.

Action

Android

0

Free

com.varomoney.bank

Report a Problem

More About Varo Bank: Mobile Banking

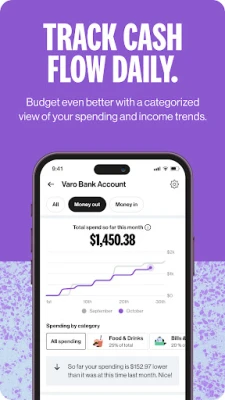

Protect Your Money is an application that offers a variety of financial services to help you manage and grow your money. One of its main features is that all deposits made through the app stay with Varo, rather than being transferred to a third-party bank. This provides transparency and ensures that your money is always easily accessible through the app. Additionally, Varo Bank Accounts are FDIC insured up to $250k per depositor, giving you peace of mind that your money is safe and secure.

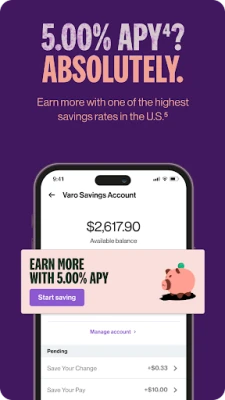

With Varo, you can also keep more of your money by avoiding monthly fees, minimum balance requirements, and overdraft fees. The app also provides access to over 40,000 fee-free Allpoint® ATMs across the United States, making it easy to access your money whenever you need it. Varo also offers auto-saving tools and a high-yield savings account with up to 5% APY, allowing you to grow your money even further.

Another benefit of using Varo is that you can get your money faster. The app allows you to receive direct deposits from your employer or government payers up to 2 days earlier than your scheduled pay date. You can also borrow up to $500 over time for unexpected expenses, with one of the highest advance limits available. Varo also offers instant money transfers to anyone, making it easy to send and receive money quickly and for free. And when you sign up, you'll receive a contactless Varo Bank Debit Card for easy and secure transactions.

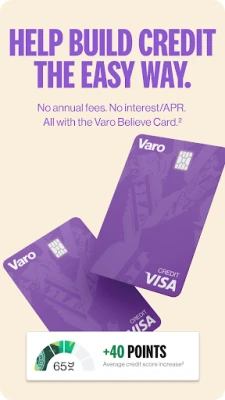

In addition to managing and growing your money, Varo also helps you build your credit. The app offers a secured credit card, Varo Believe, with no security deposit required once you qualify. By consistently making on-time payments, Varo Believe can help improve your credit score. In fact, customers who had an existing VantageScore® 3.0 credit score saw an average increase of 40 points after three months of using Varo Believe with no late payments.

Varo is committed to transparency and does not hide any fees. All fees are clearly outlined on their website. The app also offers a variety of financial services, including a line of credit, to help you manage unforeseen expenses. And with Varo, you won't have to worry about overdraft fees, as transactions will simply be declined if you don't have sufficient funds. Varo is a member of the FDIC and all Varo Visa® Debit & Believe Cards are issued by Varo Bank, N.A. under license from Visa U.S.A. Inc.

Rate the App

User Reviews

Popular Apps