Latest Version

3.60.48

November 26, 2024

U.S. Bank Mobile

Action

Android

0

Free

com.usbank.mobilebanking

Report a Problem

More About U.S. Bank Mobile Banking

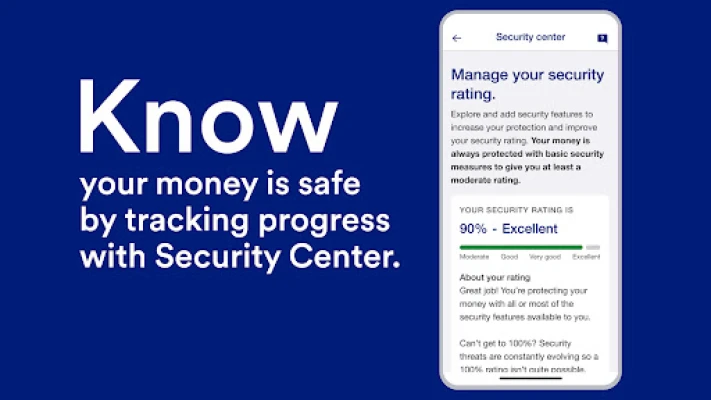

This app allows you to easily access and manage your digital services at usbank.com. If you don't have online access, you can enroll through the app. Once logged in, you can receive alerts for duplicate charges, suspicious activity, and low balances.

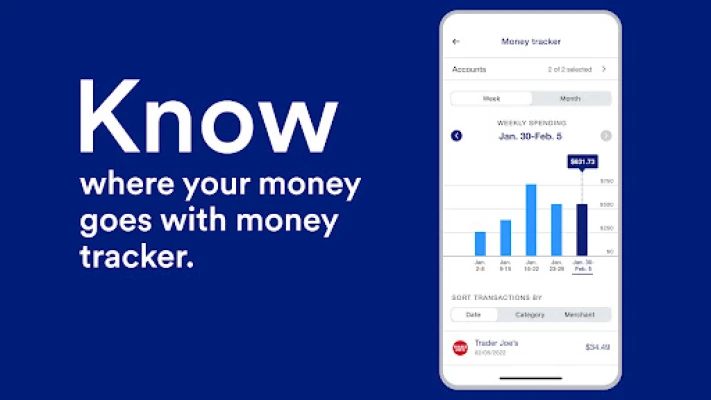

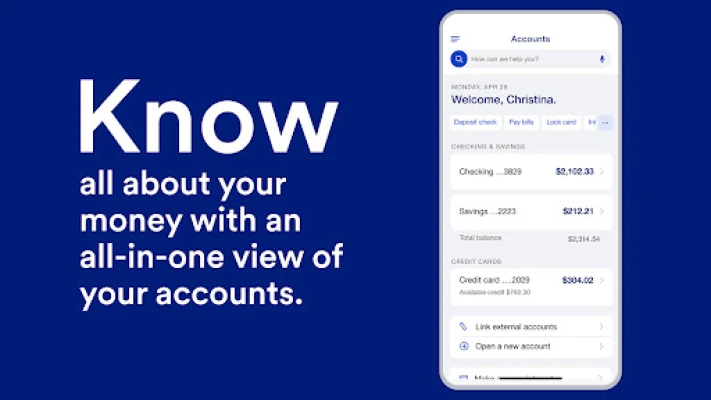

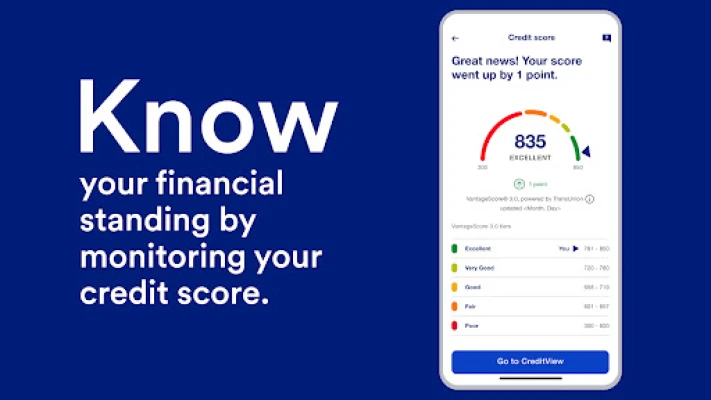

You can also manage your accounts and cards through the app. This includes viewing all your balances in one place, from checking and savings accounts to credit cards and loans. You can also securely access your credit score and perform actions such as setting travel notifications, locking and unlocking cards, and adding cards to your mobile wallet. The app also offers language preferences in English or Spanish.

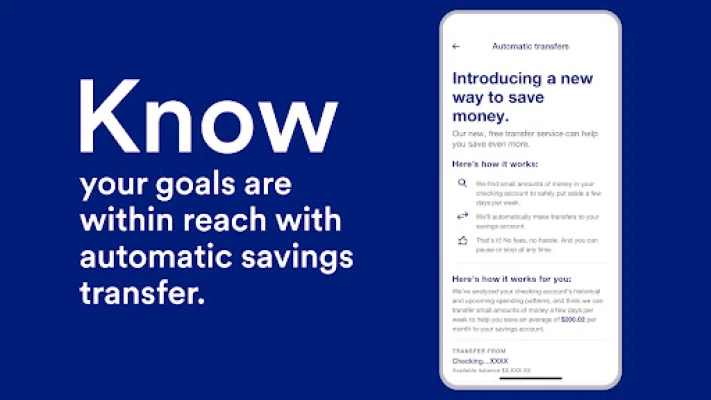

With personalized insights, you can review your monthly spending in key categories and receive recommendations on how to save and grow your money based on your spending history.

The U.S. Bank Smart Assistant® feature allows you to manage your accounts by simply asking questions or giving commands, such as checking your routing number or transferring money between accounts.

The app also makes it easy to move money by using Zelle® to send and request money from friends and family. You can also quickly deposit checks with increased limits, pay and manage bills, and make transfers between U.S. Bank accounts.

If you're looking for new accounts, credit cards, loans, or small business accounts, you can explore and apply for them directly through the app. You can also access helpful resources such as the Help Center for commonly asked questions, banking demos on Digital Explorer, and the option to schedule an appointment with a banker or receive real-time support through Cobrowse. The app also allows you to locate branches and ATMs near you.

The app also offers access to U.S. Bancorp Investments accounts and balances, as well as the ability to make transfers between U.S. Bank and U.S. Bancorp Investment accounts.

U.S. Bank has been ranked #1 for mobile app by industry benchmarking firm Keynova Group. The app also offers the convenience and security of Zelle® for money transfers, and U.S. Bank is committed to protecting your privacy and security through various policies and guarantees.

Investment and insurance products and services, including annuities, are available through U.S. Bancorp Investments, a subsidiary of U.S. Bancorp and affiliate of U.S. Bank. These products are not deposits, not FDIC insured, may lose value, not bank guaranteed, and not insured by any federal government agency.

U.S. Bank is an Equal Housing Lender and offers credit products through U.S. Bank National Association, while deposit products are offered by U.S. Bank National Association. U.S. Bank is not responsible for the products, services, or performance of U.S. Bancorp Investments.

Overall, this app provides a convenient and secure way to manage your accounts, cards, and finances, with access to helpful resources and the ability to explore and apply for new products.

Rate the App

User Reviews

Popular Apps