Latest Version

3.74.0.106633

November 14, 2024

Starling Bank

Action

Android

0

Free

com.starlingbank.android

Report a Problem

More About Starling Bank - Mobile Banking

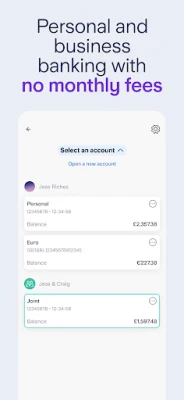

Our bank offers personal, business, and joint accounts that make managing your money easy and convenient. You can open an account online for free from your phone, and join the millions who have already discovered the better way to bank in 2024.

With our accounts, you can earn interest on your money, with a competitive rate of 3.25% AER / 3.19% Gross (variable) on balances up to £5,000 for personal and joint accounts. Interest is calculated daily and paid monthly. AER stands for Annual Equivalent Rate and represents what the interest rate would be if it was compounded once a year. Gross is the interest rate before taxes are deducted.

Our bank also offers no overseas fees, meaning you won't be charged for using your card abroad or withdrawing cash from an ATM. We use the Mastercard exchange rate and provide notifications in both the local currency and GBP.

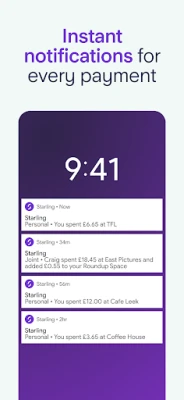

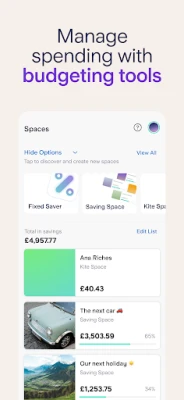

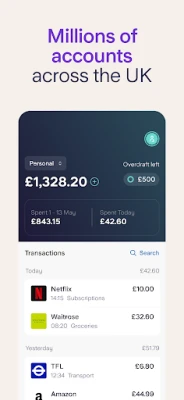

We also offer helpful budgeting tools, such as Spaces, which allows you to set money aside in a virtual change jar and track your progress. You can also receive instant payment notifications and track your balance in real-time. Our Spending Insights feature helps you understand where your money goes and how to make savings. You can also use Bills Manager to set aside money for bills, and our autopilot feature rounds up payments to the nearest pound and saves the spare change. Additionally, you can connect to other money management tools through our Starling Marketplace.

Our bank also makes it easy to pay and get paid seamlessly. You can send a simple link to get paid back, make easy international transfers to 37 countries, and pay people instantly in-app without needing a card reader. You can also deposit cheques digitally from your phone and pay in cash at the Post Office.

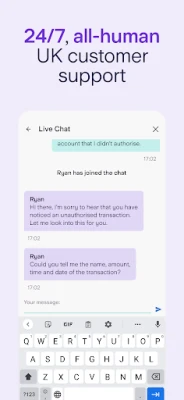

We prioritize the safety of your money, with coverage up to £85,000 by the Financial Services Compensation Scheme. Our 24/7 in-app support from real humans in the UK is always available to help. You can also lock your card in-app and adjust settings for contactless, online, gambling, and swipe payments.

For business banking, we offer no monthly fees and provide mobile and web banking access, 24/7 support, and simplified accounting. You can deposit cash at the Post Office for as little as £3 and deposit cheques in-app by taking a photo. Our business accounts also offer features such as automated expenses, ring-fencing money for bills, and smart analytics to track spending. We were voted Best Business Banking Provider in 2023.

Our joint account simplifies shared spending for households or saving up for something big together. You can earn interest, receive instant payment notifications, track spending with Insights, and make important payments from one account.

We also offer banking for the whole family with our Kite debit card and app for 6-15 year olds. It is seamlessly integrated into the adult's Starling account for better visibility and control.

Starling Bank is registered in England and Wales and is authorized by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. We strive to provide a seamless, simple, and satisfying banking experience for all our customers.

Rate the App

User Reviews

Popular Apps