Latest Version

4.23.0

December 05, 2024

Novo Platform Inc.

Action

Android

0

Free

com.novo.android

Report a Problem

More About Novo - Small Business Checking

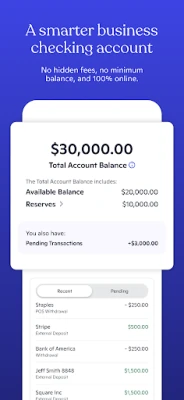

Novo is a convenient and efficient way for small businesses to apply for a bank account online. This process takes only a few minutes, allowing business owners to spend more time focusing on their business rather than dealing with the hassle of traditional banking methods. Novo is not a bank itself, but rather a fintech company that partners with Middlesex Federal Savings to provide banking services. This partnership ensures that all banking services provided by Novo are FDIC insured.

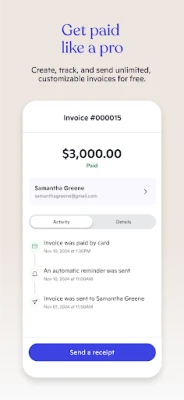

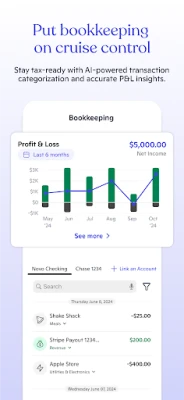

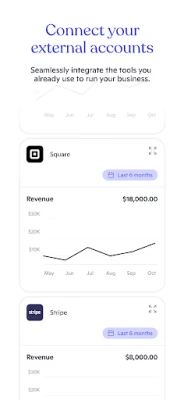

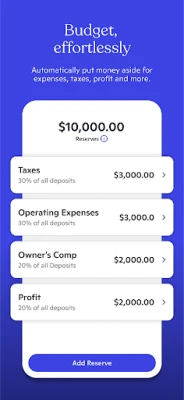

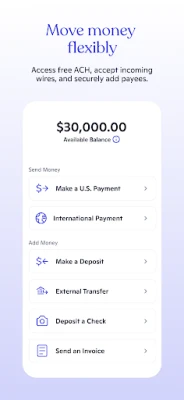

Novo offers a variety of free banking tools within their app, making it a one-stop-shop for small businesses. These tools include the ability to link existing accounts, control debit card usage, pay bills, process ACH transfers, deposit checks, categorize transactions, and set aside funds for savings in Reserves. This comprehensive range of services makes managing finances easier and more efficient for small business owners.

Upon opening a Novo account, business owners will receive a Novo Mastercard Business Debit Card and a virtual card for online purchases. These cards can be used worldwide and at any ATM without incurring fees from Novo. Additionally, Novo allows for unlimited payments and paper checks to be sent for free, providing even more convenience and cost savings for small businesses.

Novo is available for almost any business operating in the United States, as long as the owner has a social security number. This makes it accessible to a wide range of businesses, from sole proprietors to larger companies. With Novo, business owners can easily and quickly open a business checking account, without the need for extensive paperwork or in-person visits to a bank branch.

In summary, Novo is a user-friendly and efficient option for small businesses to open a bank account online. With its partnership with Middlesex Federal Savings, comprehensive banking tools, and accessibility to a wide range of businesses, Novo is a valuable resource for business owners looking to streamline their financial management.

Rate the App

User Reviews

Popular Apps