Latest Version

7.117.0

January 17, 2025

MoneyLion Inc.

Action

Android

0

Free

com.moneylion

Report a Problem

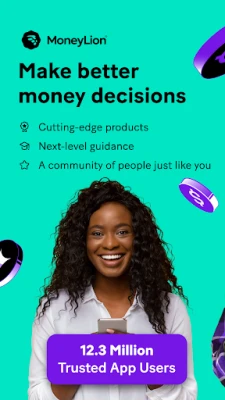

More About MoneyLion: Bank & Earn Rewards

RoarMoney is a banking application that allows users to get paid early, up to two days in advance, through direct deposit. By opening a RoarMoney account, users can also invest their extra cash through Round Ups. Additionally, users can access cash advances up to $1000 with qualifying recurring direct deposits.

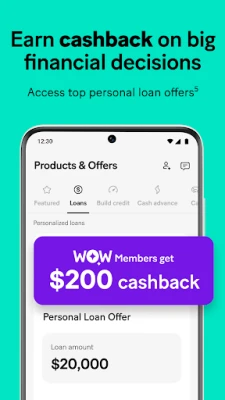

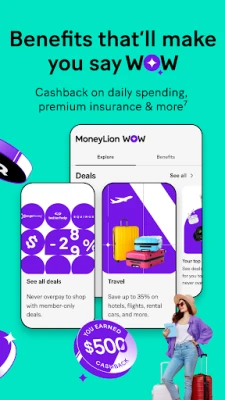

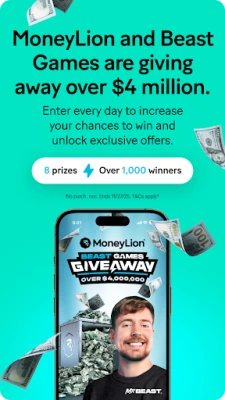

The application also offers cashback and rewards through MoneyLion WOW. Users can earn rewards on big financial decisions or everyday spending and protect themselves with exclusive benefits such as cell phone insurance and travel protection.

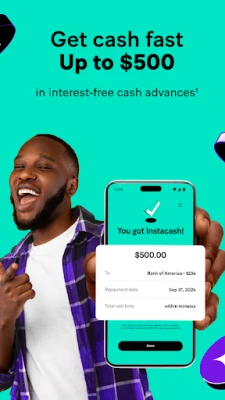

With Instacash, users can access up to $500 of their paycheck any day with no interest, mandatory fees, or credit check. This service is provided by MoneyLion and the available limit is based on direct deposits, account transaction history, and other factors. Users can also increase their Instacash limit with Safety Net by having recurring direct deposits into their RoarMoney account.

For those in need of a loan, the application offers fast loan offers from partners on the MoneyLion Marketplace. Users can compare personal loan offers, small loans, online loans, savings accounts, and more. Additionally, users can improve their credit score with a Credit Builder loan of up to $1000 and exclusive services with a membership.

It is important to note that MoneyLion is not affiliated with other money apps, loan apps, or instant cash advance apps. This includes popular apps such as Dave, SoFi, Ally Bank, Chime, and more. Users should also be aware of the terms and conditions for each service, as well as eligibility requirements.

Overall, RoarMoney offers a variety of services to help users manage their finances and access funds quickly. From early direct deposit to cash advances and loans, the application aims to provide convenience and financial stability for its users.

Rate the App

User Reviews

Popular Apps