Latest Version

1.94.1112

November 14, 2024

Kikoff, Inc.

Action

Android

0

Free

com.kikoff

Report a Problem

More About Kikoff - Build Credit Quickly

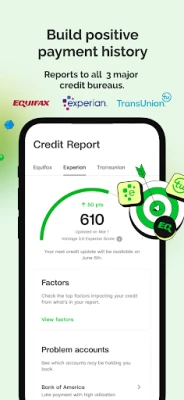

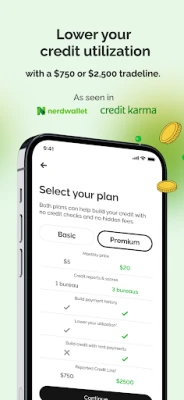

Kikoff is an application that helps customers improve their credit score by an average of 58 points through on-time payments. Customers can sign up for either the Basic plan for $5/month or the Premium plan for $20/month. With either plan, customers will have a credit line reported to Equifax, Experian, and TransUnion every month. This payment history will contribute to building their credit score, making it a worry-free process for those with low or no credit. The application also does not require a credit check and only takes a few minutes to apply.

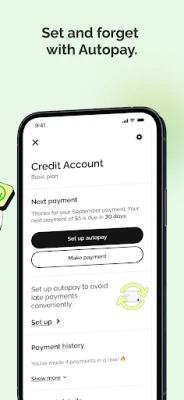

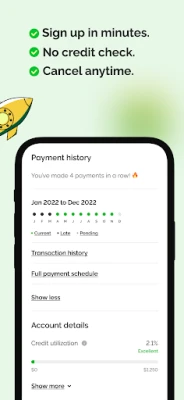

The process of building credit with Kikoff is simple. First, a customer's credit utilization is lowered with a $750 or $2,500 tradeline. Then, the customer makes a purchase with that tradeline, limited to Kikoff, and only pays back what they spend. The minimum payment amount is $5/month, which is the most popular option. These payments are reported to the credit bureaus every month, while the customer's utilization rate remains low. Customers also have the option to put their credit building on autopilot by turning on AutoPay, making the process even easier after the initial account setup.

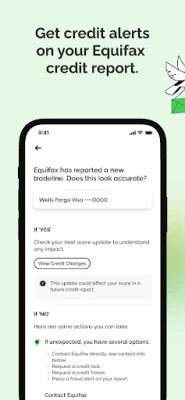

Kikoff also offers additional services to help customers improve their credit. They flag any errors on a customer's credit report and offer a Rent Reporting service for Premium Credit Service account holders. This means that customers can have their rent payments reported to the credit bureaus, further contributing to their credit score.

Kikoff's goal is to help customers build credit by establishing a payment history and maintaining a low utilization rate, all without any unexpected fees or interest. It is important to note that individual results may vary, and the impact on a customer's credit score may depend on their payment behavior. However, data from March 2022 shows that Kikoff has been successful in helping customers with a credit score of 600 or below. The credit bureaus that are reported to may vary depending on the Kikoff products a customer has, but both the Kikoff Credit Account and Secured Credit Card report to Equifax, Experian, and TransUnion.

Rate the App

User Reviews

Popular Apps