Latest Version

13.4.8

November 30, 2024

Banco Inter SA

Action

Android

0

Free

br.com.intermedium

Report a Problem

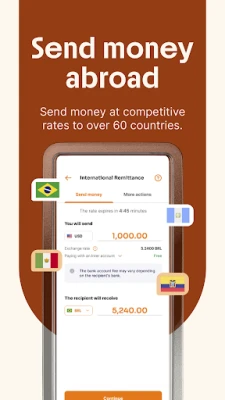

More About Inter&Co: Financial APP

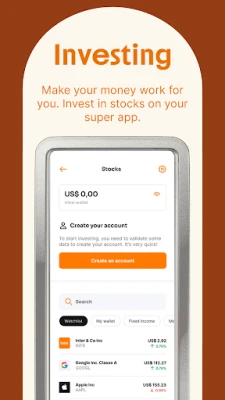

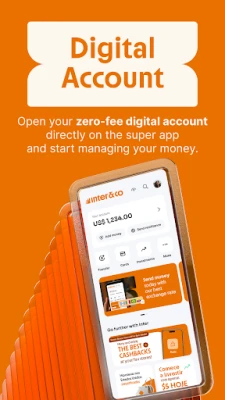

The Inter&Co super app offers a variety of services and benefits that can be accessed directly from your phone. With this app, you can easily send money to over 60 countries, invest in stocks and ETFs with as little as $5, and deposit checks to your Inter&Co digital account. This makes managing your finances and making transactions more convenient and efficient.

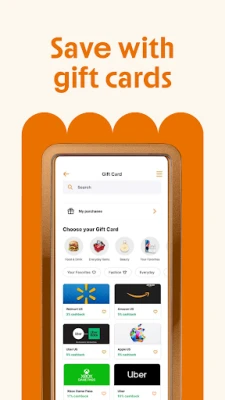

One of the key features of the Inter&Co app is the ability to explore cashback offers and deals with gift cards from top brands. By signing up for the Inter&Co LOOP rewards program, you can earn points that can be exchanged for gift cards and other rewards. This adds an extra layer of value and benefits for users of the app.

It is important to note that INTER & CO PAYMENTS INC., the company behind the Inter&Co app, is a regulated entity authorized to operate under the laws and regulations of the United States of America. However, it is not a bank. The debit card associated with your Inter&Co account is issued by American Bank, a member of the FDIC, and is licensed by Mastercard®. This ensures the security and legitimacy of the app and its services.

The Inter&Co Account deposits are held by Community Federal Savings Bank, a member of the FDIC. This provides an added layer of protection for users' funds. If you have any questions or concerns about any transactions made through the app, you can easily contact the Inter&Co team for assistance via email or phone.

In summary, the Inter&Co super app offers a range of financial services and benefits, including international money transfers, stock and ETF investments, and cashback offers with gift cards. It is a regulated entity and works in partnership with reputable financial institutions to ensure the safety and security of users' funds. Download the app today to start taking advantage of these convenient and valuable features.

Rate the App

User Reviews

Popular Apps