Latest Version

4.67.0

December 01, 2024

Green Dot

Action

Android

0

Free

com.cardinalcommerce.greendot

Report a Problem

More About Green Dot - Mobile Banking

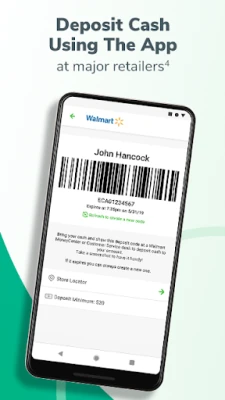

The Green Dot app offers a variety of features for users to manage their Green Dot cards. These features include early direct deposit, the ability to send money and pay bills, deposit cash using the app, and no minimum balance requirement. Additionally, select Green Dot cards offer even more features such as access to a free ATM network, overdraft protection, cash back on online and mobile purchases, and a high-yield savings account with a 2.00% Annual Percentage Yield (APY) on balances up to $10,000.

The app is the most convenient way to manage your account, allowing you to activate a new card, view your balance and transaction history, lock or unlock your account, deposit checks from your mobile phone, and set up account alerts. It also works with mobile payment options like Apple Pay and offers access to customer support through chat.

To use the Green Dot app, you must be 18 years or older and have online access, a mobile number, and pass identity verification. You will also need to activate a personalized card to access some features. It is important to note that the name and Social Security number on your Green Dot account must match the information on file with your employer or benefits provider to prevent fraud restrictions.

Some important details to keep in mind include the fact that early direct deposit availability may vary from pay period to pay period, fees and terms apply for overdraft protection, and there is a retail service fee of $4.95 for depositing cash using the app. Additionally, there are limits on certain features such as the number of free ATM withdrawals per month and the amount of cash back you can earn.

The Green Dot app is available for both Visa and Mastercard Green Dot cards, and is issued by Green Dot Bank, Member FDIC. Message and data rates may apply. For more information, visit GreenDot.com.

Rate the App

User Reviews

Popular Apps