Latest Version

8.68.0

January 17, 2025

gohenry Ltd

Action

Android

0

Free

com.pktmny.mobile

Report a Problem

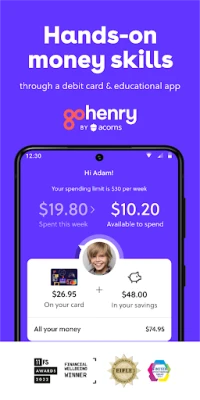

More About GoHenry by Acorns Kids Banking

GoHenry by Acorns Kids’ Banking Benefits is an application that aims to teach children and teens about financial literacy and money management skills. It offers various features and benefits for both parents and their children, such as automated allowance, savings goals, in-app task lists, and bite-sized lessons.

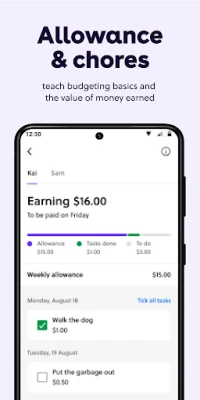

One of the main features of GoHenry by Acorns is the automated weekly allowance, which helps children learn budgeting skills by setting a fixed amount of money each week and teaching them that once the money is gone, it's gone. This encourages children to be more mindful of their spending habits and to prioritize their expenses.

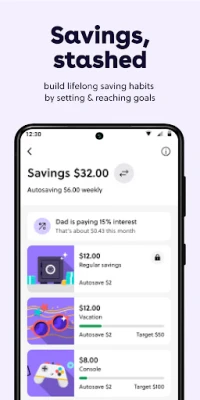

The app also allows parents to set savings goals for their children, which can be locked or unlocked depending on the child's progress. This feature promotes saving habits and teaches children the value of setting and achieving financial goals.

In addition, GoHenry by Acorns offers in-app task lists that allow parents to incentivize chores by sending rewards for completed tasks. This teaches children the power of earning and the importance of hard work.

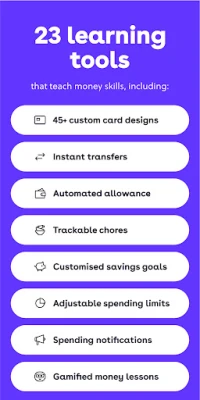

The app also includes bite-sized lessons called Money Missions, which aim to boost a child's financial literacy. These lessons have been proven to increase the amount of money children transfer into their savings accounts by over 30% in the first month after completion.

GoHenry by Acorns also provides children with their own prepaid debit card, which they can use to practice their new money management skills in the real world. With over 45 designs to choose from, children can personalize their card and feel a sense of ownership over their finances.

For parents, the app offers quick and easy transfers, real-time spending visibility, and flexible controls over their child's spending. They can also track their child's money and receive notifications straight to their phone. Additionally, the app has a Parent Space section where parents can find insights and tips to support their child's financial education.

For teens, GoHenry by Acorns offers a teen debit card and account with features specifically designed for their age group. They can request or send money to friends, set savings goals, and even get paid through direct deposits. The app also allows them to track their spending habits and make fee-free transactions overseas.

To get started with GoHenry by Acorns, parents can sign up and download the app, while teens will need a parent or guardian to sign them up. The app has received over 54,000 5-star reviews on Trustpilot and the App Store and Google Play stores worldwide, making it a trusted and popular choice for teaching children and teens about financial responsibility.

Overall, GoHenry by Acorns is a comprehensive and user-friendly application that provides valuable tools and resources for children, parents, and teens to learn and practice financial skills. It is not a bank, but the GoHenry card is issued by Community Federal Savings Bank, member FDIC, under license by Mastercard International. The app also offers the option for charitable donations, promoting the value of helping others and giving back to the community.

Rate the App

User Reviews

Popular Apps