Latest Version

10.31.0

December 09, 2024

BlueVine Inc.

Action

Android

0

Free

org.bluevine.depositapp

Report a Problem

More About Bluevine

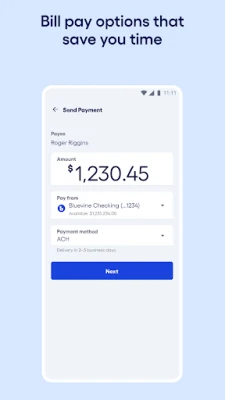

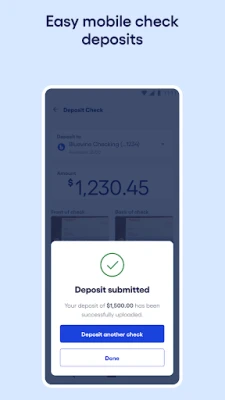

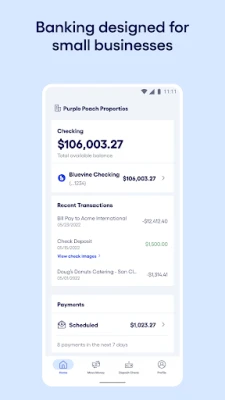

Earn more interest with Bluevine's business checking plans. Eligible customers can earn competitive interest on balances up to $3 million. Say goodbye to monthly fees and enjoy unlimited deposits and payments with no minimum opening deposit or balance requirements. With the ability to manage up to 5 sub-accounts, budgeting for taxes, payroll, and more has never been easier. And with the convenience of mobile banking, you can deposit checks, transfer funds, and pay bills from anywhere. Rest assured that your Bluevine account is protected with industry-leading security protocols and FDIC insurance up to $3 million per depositor through Coastal Community Bank. For more information, visit the Bluevine website.

Bluevine has been making headlines with their innovative banking products for small businesses. They are not a bank themselves, but partner with Coastal Community Bank to provide banking services. The Bluevine Business Debit Mastercard® is issued by Coastal Community Bank and can be used wherever Mastercard is accepted. Your privacy is important to Bluevine and Coastal Community Bank, and their privacy policies can be found on their respective websites.

Depending on your chosen plan, you may automatically earn interest on your available balances. Standard plan customers can also earn interest if they meet certain eligibility requirements. Interest is earned on total balances up to $250,000 for Plus and Standard customers, and up to $3 million for Premier customers. There is no limit on the number of transactions, but monthly deposit and withdrawal limits apply. Sub-accounts can only be opened on the desktop or mobile browser version of the Bluevine Dashboard, and a Bluevine Business Debit Mastercard will only be provided for the main account. While there is a $2.50 fee for ATM transactions outside of the MoneyPass® network, you can deposit or withdraw funds at over 37,000 in-network locations nationwide.

With Bluevine, small businesses can earn more interest, budget better with multiple accounts, bank from anywhere, and have peace of mind with advanced security measures. Don't just take our word for it, see what TechCrunch and Banking Dive have to say about Bluevine's success and vision for the future. For more information and to get started, visit the Bluevine website today.

Rate the App

User Reviews

Popular Apps